Gas and electric bills can be confusing. The bill balance fluctuates with the warming and cooling seasons and it’s easy to lose track of what your balance really means.

Below we show a reminder of the in-debit meaning with an example bill and some tips on how to remember.

Table of Contents

What Is the Meaning of In Debit on your Energy Bill?

An “in debit” balance on your energy gas and electricity bill means you owe the energy supplier money. You have used more energy than you have paid for up to the balance date.

This situation could come about due to various reasons and is not always a bad thing but is something to be aware of as it might affect your future monthly payments.

Here are some other ways to help you remember the meaning:

- An easy way to remember is that both debit and debt start with the letter D ( as well as all letters from the word debt are in the word debit). You are in debt to the energy company. Being “in debit” is like a debt. Or the fact the

- In debit is a minus figure, e.g -£119, minus means your account is negative, you, therefore, owe money.

What does In Credit Mean on an Energy Bill

Sometimes the energy billing system can work in your favour if you are consistently using less energy through the year than you are paying for you may build up an “In Credit balance”.

An In credit balance means you have paid for more energy than you have used and the energy company is holding the surplus money you have paid in your energy account.

This is often the case in the summer months when our energy bills are typically lower but we still pay the same average monthly bill via direct debit.

Many energy companies offer generous refer friend incentives from which just referring a handful of friends and family can make you £100’s. These payments may well exceed your monthly energy usage bills and put your account “in credit”.

If you are consistently overpaying, perhaps your actual annual usage is much lower than your estimated usage, you can request a refund of your in credit balance, or lower your monthly payments.

Reasons Why Your Energy Account Might be In Debit

Most energy companies allow you to pay a fixed monthly direct debit to help even out the monthly payments over the course of the year.

This helps people budget better, rather than all of a sudden have an energy bill that could be two or three times as much as it was a couple of months ago.

There are a few reasons why your energy account can build up a minus in debit balance.

Seasonal

Energy use is typically seasonally here in the UK. Many energy companies will charge you a monthly direct debit based on your past annual energy usage or an estimate if you have recently switched to them.

Over the course of the colder winter months, it is not uncommon to see your energy bill balance be “in debit”, possibly up to a couple of hundred pounds or more because you are using more energy than the monthly direct debit pays for.

For example, perhaps your monthly energy bill was £120 a month from November to December and the direct debit only £80 a month.

Each month therefore your balance would fall a further £40 in debit.

However, as the warmer weather arrives, and you are still being billed £80, your energy bills might fall as low as £40 a month, reducing the in debit balance every month accordingly.

Your Using More Energy

You’re in debit balance may increase if your household starts using more energy.

For example, perhaps you have purchased a device that is consuming lots of energy such as new heaters or a more luxurious treat like a hot tub or heating an outdoor pool.

Or your general heating bill has been underestimated from the start and an in debit balance is constantly building.

Energy Price Increase

Perhaps your in-debit balance is slowly increasing because your energy rates have increased.

At certain times all energy prices increase, but at others, some individual companies increase prices more than others or leave existing customers on old more expensive tariffs compared to cheaper ones they have since released to attract new customers.

Whether your energy company is the likes of EDF, Scottish Power or British Gas they all move their prices around and although at times may be cheap, rarely is that continually the case.

They also have their own range of tariffs, some of which might not be the best price for you but they leave you on it even though cheaper options might be available.

It’s always worth checking if you can switch to cheaper energy elsewhere and take advantage of an offer like Eon Next refer a Friend £50 credit or use a service like Look After My Bills to monitor your tariffs and keep you o one of the cheapest available.

Disadvantages of a High In Debit Balance

While being in debit on your energy account can be totally normal there are some possible disadvantages of letting the figure get too high.

Switching Energy Supplier When in debit

You can switch to a cheaper energy supplier you will have to clear the balance of your existing supplier as part of the switch.

If this balance has built up over several months it could be at least a couple of hundred pounds. Plus typically your new energy supplier will want to effectively charge you a month in advance by charging you on the day of the switch.

This can certainly limit some people from switching at all until they have caught up on reducing the in debit balance.

I personally would prefer to pay a little more to prevent my balance from going overly into debt and prefer building up a bit of credit. This helps immensely with switches as I usually get a refund too.

How and When to Reduce Minus In debit Balance

If your debit balance starts getting too high your energy company will usually increase your monthly direct debit accordingly.

Most energy companies allow you to adjust your own monthly direct debits so you could increase them yourself to reduce the likelihood of building up too much debt in your energy account.

Another option is to make a one-off payment to reduce it to a more comfortable level.

Example of Energy Bill In Debit Balance & Statement

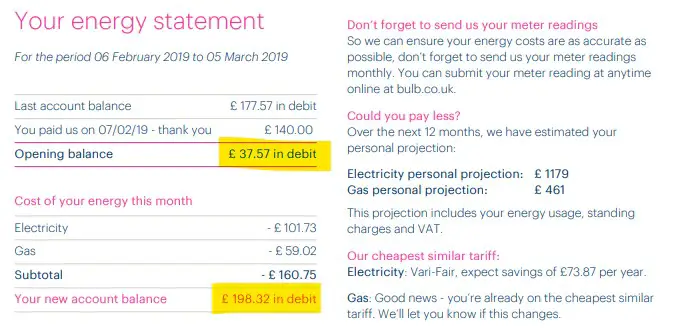

Below is an example of one of my own past energy bills when my account was in debit.

As you can see, the statement is for the last weeks of winter 2019.

I started the billing period £37.57 in debit (see the opening balance). This means that up to this point I had underpaid £37.57 on my energy bill.

I therefore effectively owed my energy company £37.57. Although the balance isn’t actually shown as a minus in this particular energy statement, it is a negative balance.

Minus from this opening negative balance the cost of energy used during this billing month, gas and electric costs of -£101.73 and -£59.02 for a combined total of -£160.75.

- Opening balance of £-37.57 in debit

- Minus another -£160.75 is which needs to be deducted from my account (-£37.57 – £160.75)

- Leaving my new account balance -£198.32 in debit (effectively behind in payments)

This sounds quite a lot but this is for the 5th of March and my direct debit for £140 goes towards paying a large chunk of that off just 2 days later.

In this particular month, I used £160.75 of entry was still only paying £140 direct debit, at that rate my in debit balance would increase by £20.75 for the month.

Summer Billing Back In Credit

However, by the summer months, I was only using the following amounts of energy and therefore overpaying with my £140 direct debit. I’ve put the difference in energy used and the direct debit amount in brackets.

- July £94 (overpaid £46)

- August £84 (overpaid £56)

- September £81 (overpaid 59)

So by the time of my September statement I was £198.43 in credit just continuing to pay £140 a month.

Keep Direct Debit On Par with Annual Costs

On the right-hand side of the above statement photo, you can see my annual estimates of:

- Electricity £1179 a year

- Gas £461 a year

A total of £1640 a year, for an average of £136.36 a month.

Therefore, with us paying £140 a month over the course of 12 months I should be in credit.

The ups and downs of the in debit or in credit are just part and parcel of the natural billing cycle.

If however, your monthly direct debit works out much less than your average monthly energy consumption costs you could be in a position where the in debit balance keeps on increasing and your monthly payments will need to be increased more significantly to make up the shortfall and also the backlog of debt that’s been allowed to build up.

Related Posts

- What’s the cheapest way to heat a room?

- Wayleave payments for electricity poles and overhead powerlines

Frequently Asked Questions

Does In Debit Mean in Debt?

In debit means your energy account is in debt to the energy supplier.

Is it better to be in debit or in credit with your energy supplier?

If your monthly energy bills even out with your monthly payments over the year, it doesn’t really matter if your account goes in debit or in credit at various times of the year. In credit is generally better because it means you are not underpaying for your energy and building up a negative balance.

Does an In Debit balance on energy bill affect Credit Score?

An in debit balance on your energy bill will not affect your credit score as long as you continue to pay your monthly direct debit.